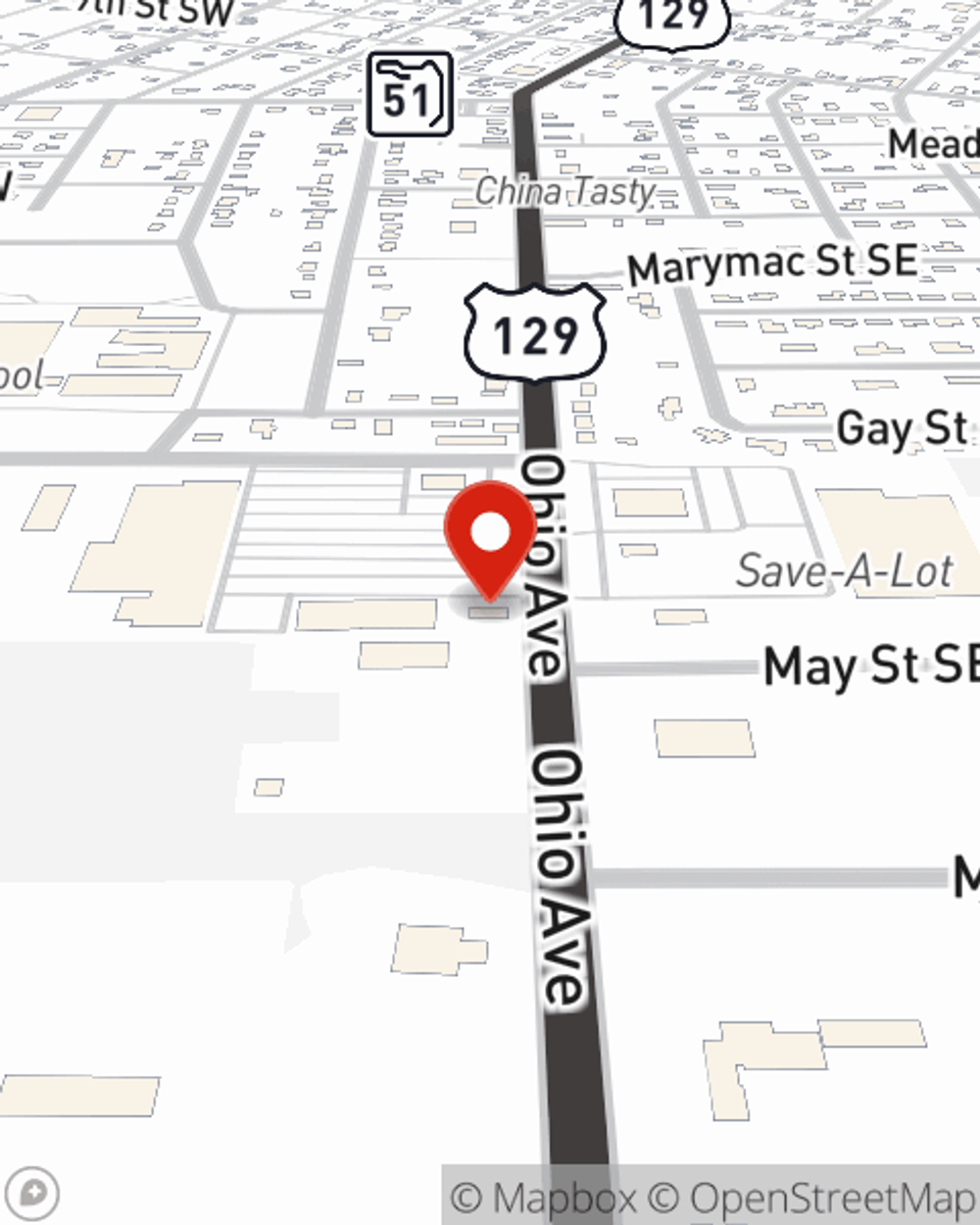

Condo Insurance in and around Live Oak

Welcome, condo unitowners of Live Oak

Condo insurance that helps you check all the boxes

- Live Oak

- Suwannee County

- Layfayette County

- Hamilton County

- Columbia County

- Lake City

- Jasper

- McAlpin

- Branford

- Mayo

- Jennings

- O'Brien

- Madison County

- White Springs

Home Is Where Your Condo Is

As with anything in life, it is a good idea to expect the unexpected and attempt to prepare accordingly. When owning a condo, the unexpected could look like damage to your condo and its contents from theft fire, weight of ice, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Welcome, condo unitowners of Live Oak

Condo insurance that helps you check all the boxes

Protect Your Home Sweet Home

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance covers more than your condo. It protects both your condo and your precious belongings. In case of a burglary or a tornado, you may have damage to some of your possessions beyond damage to the actual condo. If your belongings are not insured, you may struggle to replace all of the things you lost. Some of your possessions can be replaced if they damaged even when they are outside of your condo. If your bicycle is stolen from work, a condo insurance policy might come in very handy.

Call or email State Farm Agent Derek Loadholtz today to check out how one of the leading providers of condominium unitowners insurance can help protect your townhome here in Live Oak, FL.

Have More Questions About Condo Unitowners Insurance?

Call Derek at (386) 364-3535 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Derek Loadholtz

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.